Creating a successful financial plan is essential for achieving your financial goals, whether it’s saving for a home, planning for retirement, or building an emergency fund. In 2024, with evolving economic conditions and technological advancements, it’s crucial to adopt strategies that ensure your financial stability and growth. Here’s a comprehensive guide on how to create a successful financial plan in 2024, complete with tips and images to help you along the way.

Successful financial planning sets the foundation for achieving your financial goals.

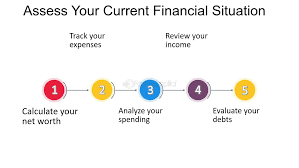

1. Assess Your Current Financial Situation

Before you can create a plan, you need to understand where you stand financially. Start by listing all your assets, liabilities, income, and expenses.

Steps to Assess Your Financial Situation:

- List Assets: Include cash, savings, investments, and valuable possessions.

- List Liabilities: Include debts such as mortgages, car loans, and credit card balances.

- Calculate Net Worth: Subtract your total liabilities from your total assets.

- Track Income and Expenses: Use tools or apps to track your monthly income and expenses.

Assessing your current financial situation is crucial for planning effectively.

2. Set Clear Financial Goals

Setting specific, measurable, achievable, relevant, and time-bound (SMART) goals is crucial for a successful financial plan. Your goals should cover short-term, medium-term, and long-term objectives.

Tips for Setting Goals:

- Short-Term Goals: Save for a vacation, pay off credit card debt, or build an emergency fund.

- Medium-Term Goals: Save for a down payment on a house, pay off student loans, or start a business.

- Long-Term Goals: Plan for retirement, save for children’s education, or build substantial wealth.

Setting SMART goals helps keep your financial plan on track.

3. Create a Budget

A well-structured budget is the backbone of any successful financial plan. It helps you manage your money effectively, ensuring you live within your means and save for your goals.

Steps to Create a Budget:

- Track Your Income: Include all sources of income, such as salary, freelance work, and investments.

- List Your Expenses: Categorize expenses into fixed (rent, utilities) and variable (groceries, entertainment).

- Set Spending Limits: Allocate a specific amount for each expense category.

- Review and Adjust Regularly: Monitor your budget monthly and make adjustments as needed.

Creating a budget helps you manage your finances effectively.

4. Build an Emergency Fund

An emergency fund is crucial for handling unexpected expenses without derailing your financial plan. Aim to save three to six months’ worth of living expenses.

Tips for Building an Emergency Fund:

- Start Small: Begin with a small, achievable amount and gradually increase your savings.

- Automate Savings: Set up automatic transfers to your emergency fund to ensure consistent contributions.

- Keep it Accessible: Store your emergency fund in a separate, easily accessible account.

An emergency fund provides financial security during unexpected events.

5. Manage and Pay Off Debt

Managing debt effectively is key to financial stability. Focus on paying off high-interest debt first, while making minimum payments on other debts.

Strategies for Debt Management:

- List All Debts: Include interest rates and minimum payments.

- Prioritize High-Interest Debt: Pay off debts with the highest interest rates first.

- Consider Debt Consolidation: Look into consolidation loans or balance transfer cards to reduce interest rates.

Effective debt management is essential for financial health.

6. Invest for the Future

Investing is a critical component of building wealth. In 2024, consider a mix of investment options that align with your risk tolerance and goals.

Tips for Investing:

- Diversify Your Portfolio: Invest in a mix of stocks, bonds, mutual funds, and real estate.

- Start Early: Take advantage of compound interest by starting to invest as early as possible.

- Consult a Financial Advisor: Seek professional advice to develop a personalized investment strategy.

Investing wisely helps grow your wealth over time.

7. Plan for Retirement

Retirement planning is crucial for ensuring a comfortable future. Start early and regularly review your retirement plan to stay on track.

Steps for Retirement Planning:

- Choose Retirement Accounts: Contribute to 401(k)s, IRAs, or other retirement accounts.

- Take Advantage of Employer Matches: Maximize employer matching contributions to boost your savings.

- Estimate Retirement Needs: Calculate how much you need to save to maintain your desired lifestyle in retirement.

Start planning for retirement early to secure your future.

8. Protect Your Assets with Insurance

Insurance protects your assets and provides peace of mind. Ensure you have adequate coverage for health, home, auto, and life insurance.

Types of Insurance to Consider:

- Health Insurance: Covers medical expenses and protects against high healthcare costs.

- Home Insurance: Protects your home and belongings from damage or loss.

- Auto Insurance: Covers damages and liability for your vehicle.

- Life Insurance: Provides financial support to your family in case of your untimely demise.

Adequate insurance coverage protects your assets and provides peace of mind.

9. Monitor and Improve Your Credit Score

A good credit score is vital for accessing favorable loan terms and interest rates. Regularly monitoring and improving your credit score can save you money.

Tips for Improving Your Credit Score:

- Check Your Credit Report: Regularly review your credit report for errors and discrepancies.

- Pay Bills on Time: Make timely payments to build a positive payment history.

- Reduce Debt: Lower your credit utilization ratio by paying down credit card balances.

Maintain a good credit score to access better financial opportunities.

10. Review and Adjust Your Financial Plan Regularly

A financial plan is a living document that needs regular review and adjustment. Keep it aligned with your goals and changing circumstances.

Tips for Reviewing Your Plan:

- Schedule Regular Reviews: Set quarterly or annual reviews to assess your progress.

- Adjust for Life Changes: Update your plan to reflect major life events, such as marriage, children, or career changes.

- Celebrate Milestones: Recognize and celebrate your achievements to stay motivated.

Regularly review and adjust your financial plan to stay on track.

Conclusion

Creating a successful financial plan in 2024 involves assessing your current situation, setting clear goals, budgeting, building an emergency fund, managing debt, investing, planning for retirement, protecting your assets with insurance, monitoring your credit score, and regularly reviewing your plan. By following these steps and staying committed to your goals, you can navigate the financial landscape with confidence and work towards a secure and prosperous future