In 2024, effective budgeting remains a cornerstone of financial stability and success. With economic fluctuations, rising costs, and the complexity of modern financial tools, mastering budgeting is more crucial than ever. This comprehensive guide offers practical and actionable budgeting tips to help you manage your finances efficiently, achieve your goals, and secure your financial future.

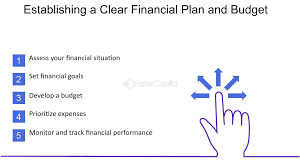

1. Start with a Clear Budget Plan

Creating a detailed budget plan is the first step toward financial control. Here’s how to get started:

- Track Your Income and Expenses: Begin by recording all sources of income and categorizing your expenses. Use budgeting apps or spreadsheets to simplify this process.

- Set Specific Goals: Define short-term and long-term financial goals, such as saving for a vacation, paying off debt, or investing in your retirement.

- Create Spending Categories: Divide your expenses into categories like housing, transportation, groceries, and entertainment to see where your money goes.

2. Use the 50/30/20 Rule

The 50/30/20 rule is a popular budgeting method that simplifies financial management:

- 50% for Needs: Allocate half of your income to essential expenses like rent, utilities, and groceries.

- 30% for Wants: Use 30% of your income for discretionary spending such as dining out, entertainment, and hobbies.

- 20% for Savings and Debt Repayment: Direct the remaining 20% toward savings, investments, and paying down debt.

3. Automate Your Savings

Automating your savings helps ensure you consistently contribute to your financial goals:

- Set Up Automatic Transfers: Arrange for a portion of your income to be automatically transferred to savings or investment accounts.

- Use Financial Apps: Many budgeting apps offer features to automate savings and track your progress toward financial goals.

4. Monitor and Adjust Your Budget Regularly

Maintaining an effective budget requires ongoing attention:

- Review Monthly: Assess your budget each month to track spending patterns and make necessary adjustments.

- Adjust for Changes: Modify your budget to reflect changes in income, expenses, or financial goals.

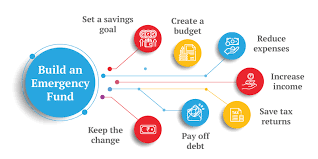

5. Build an Emergency Fund

An emergency fund is crucial for handling unexpected expenses without derailing your financial plans:

- Save 3-6 Months of Expenses: Aim to build an emergency fund that covers 3 to 6 months of living expenses.

- Keep It Accessible: Store your emergency fund in a high-yield savings account for easy access and potential growth.

6. Cut Unnecessary Expenses

Identifying and reducing unnecessary expenses can free up more money for savings and investments:

- Evaluate Subscriptions: Review and cancel unused subscriptions or memberships.

- Reduce Dining Out: Opt for home-cooked meals instead of frequent dining out to save money.

7. Use Cash-Back and Reward Programs

Leverage cash-back and reward programs to maximize your spending power:

- Credit Card Rewards: Use credit cards with cash-back or reward programs for everyday purchases.

- Loyalty Programs: Take advantage of loyalty programs for discounts and rewards at your favorite stores.

8. Plan for Major Expenses

Planning for major expenses helps you avoid financial strain:

- Save for Large Purchases: Allocate funds in advance for big-ticket items like home repairs or new appliances.

- Budget for Holidays and Gifts: Set aside money throughout the year for holidays, birthdays, and other special occasions.

9. Track Your Spending with Technology

Utilize technology to track and manage your spending effectively:

- Budgeting Apps: Use apps like Mint, YNAB, or PocketGuard to monitor expenses and stay on track with your budget.

- Expense Tracking Tools: Employ tools that sync with your bank accounts to categorize and track your spending automatically.

10. Seek Professional Financial Advice

Consulting with a financial advisor can provide personalized guidance and help you optimize your budget:

- Financial Planning Services: Consider working with a certified financial planner for advice on budgeting, investments, and long-term financial strategies.

- Tax Professionals: Consult a tax advisor to ensure you are taking advantage of tax-saving opportunities and deductions.

Conclusion

Mastering effective budgeting in 2024 involves more than just tracking your income and expenses; it requires a strategic approach to managing your finances. By implementing these top budgeting tips, you can take control of your financial future, achieve your goals, and build a secure foundation for years to come. Remember, a well-managed budget is key to financial success, and staying proactive will help you navigate the challenges and opportunities of 2024 with confidence.