As we approach 2024, investors are faced with a rapidly changing financial landscape. From technological advancements to geopolitical shifts and market trends, staying ahead of the curve requires a strategic approach to investment. This article explores effective investment strategies for 2024, offering insights into how to navigate the evolving market and make informed decisions.

1. Diversify Your Portfolio

Overview: Diversification remains a cornerstone of effective investing. By spreading investments across various asset classes, sectors, and geographies, you can mitigate risk and enhance potential returns.

Key Strategies:

- Asset Class Diversification: Incorporate a mix of stocks, bonds, real estate, and alternative investments to balance risk and reward.

- Geographic Diversification: Invest in international markets to benefit from global economic growth and reduce exposure to domestic market fluctuations.

- Sector Diversification: Allocate funds across different sectors (technology, healthcare, energy, etc.) to avoid overexposure to any single industry.

Why It’s Effective: Diversification helps cushion your portfolio against market volatility and economic downturns. It increases the likelihood of capturing gains across various market segments while minimizing potential losses.

2. Embrace Technology and Innovation

Overview: The rise of technology continues to reshape the investment landscape. Embracing technological advancements and investing in innovative sectors can offer substantial growth opportunities.

Key Strategies:

- Invest in Technology Stocks: Focus on companies at the forefront of technological innovation, such as artificial intelligence, blockchain, and cybersecurity.

- Explore Emerging Technologies: Consider investments in emerging technologies like quantum computing, 5G, and biotechnology, which have the potential to drive significant returns.

- Utilize Fintech Solutions: Leverage financial technology (fintech) tools and platforms to enhance investment management and access new opportunities.

Why It’s Effective: Technology-driven investments often experience rapid growth and transformation. By staying ahead of technological trends, you can capitalize on emerging opportunities and potentially achieve higher returns.

3. Focus on Sustainable and ESG Investments

Overview: Environmental, Social, and Governance (ESG) investing is gaining traction as investors increasingly prioritize sustainability and ethical considerations. Incorporating ESG factors into your investment strategy can align financial goals with positive social impact.

Key Strategies:

- Invest in ESG Funds: Choose mutual funds and exchange-traded funds (ETFs) that focus on companies with strong ESG practices.

- Support Green Technologies: Allocate funds to renewable energy, electric vehicles, and other green technologies that contribute to a sustainable future.

- Evaluate Corporate Practices: Assess companies’ ESG performance and commitment to ethical practices before investing.

Why It’s Effective: ESG investing not only supports ethical and sustainable practices but also addresses growing consumer and regulatory demands for corporate responsibility. Companies with robust ESG practices may experience long-term growth and stability.

4. Capitalize on Real Estate Opportunities

Overview: Real estate remains a popular investment choice, offering potential for steady income and capital appreciation. With evolving market conditions, understanding current trends can help you make informed real estate investments.

Key Strategies:

- Invest in REITs: Real Estate Investment Trusts (REITs) provide exposure to real estate without requiring direct property ownership. They offer liquidity and diversification.

- Explore Residential and Commercial Properties: Analyze local market conditions and invest in properties with strong rental yields or potential for value appreciation.

- Consider Real Estate Crowdfunding: Participate in real estate crowdfunding platforms to access a variety of projects and diversify your real estate investments.

Why It’s Effective: Real estate investments can provide a stable income stream through rental yields and benefit from property value appreciation. Diversifying into real estate can also act as a hedge against inflation and economic uncertainties.

5. Stay Informed About Global Economic Trends

Overview: Global economic trends and geopolitical developments can significantly impact investment performance. Staying informed about macroeconomic factors helps you anticipate market changes and adjust your strategy accordingly.

Key Strategies:

- Monitor Economic Indicators: Track key economic indicators such as GDP growth, inflation rates, and employment figures to gauge economic health.

- Assess Geopolitical Risks: Evaluate the potential impact of geopolitical events, trade policies, and international relations on your investments.

- Stay Updated on Central Bank Policies: Follow central bank decisions on interest rates and monetary policy, as these can influence market conditions and investment returns.

Why It’s Effective: Understanding global economic trends and geopolitical risks allows you to make proactive investment decisions and adapt to changing market conditions. It helps you identify opportunities and mitigate potential risks.

6. Implement Risk Management Techniques

Overview: Effective risk management is essential for protecting your investment portfolio from significant losses. Employing various risk management techniques can help you navigate market volatility and preserve capital.

Key Strategies:

- Set Stop-Loss Orders: Use stop-loss orders to automatically sell assets if their prices fall below a predetermined level, limiting potential losses.

- Diversify Across Asset Classes: As mentioned earlier, diversification reduces the impact of adverse movements in any single asset class on your overall portfolio.

- Regularly Review and Rebalance: Periodically review your portfolio and rebalance it to maintain your desired asset allocation and risk level.

Why It’s Effective: Risk management techniques help you protect your investments from excessive losses and maintain a stable portfolio. By proactively managing risk, you can better weather market fluctuations and preserve your long-term investment goals.

7. Consider Alternative Investments

Overview: Alternative investments offer diversification beyond traditional asset classes and can provide unique opportunities for growth. These investments can include commodities, private equity, hedge funds, and more.

Key Strategies:

- Explore Commodities: Invest in commodities such as gold, silver, and oil to hedge against inflation and market volatility.

- Consider Private Equity: Participate in private equity investments to access high-growth opportunities in privately held companies.

- Evaluate Hedge Funds: Invest in hedge funds that employ various strategies to achieve returns regardless of market conditions.

Why It’s Effective: Alternative investments can enhance portfolio diversification and potentially provide returns uncorrelated with traditional asset classes. They offer opportunities for growth and risk management that may not be available through conventional investments.

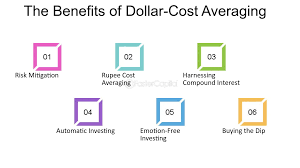

8. Leverage Dollar-Cost Averaging

Overview: Dollar-cost averaging (DCA) is an investment strategy that involves consistently investing a fixed amount of money at regular intervals, regardless of market conditions.

Key Strategies:

- Automate Investments: Set up automatic investments to contribute a fixed amount to your chosen assets or funds on a regular basis (e.g., monthly).

- Maintain Discipline: Stick to the investment plan and avoid making emotional decisions based on short-term market fluctuations.

- Focus on Long-Term Goals: Emphasize long-term investment goals rather than short-term market movements.

Why It’s Effective: Dollar-cost averaging helps reduce the impact of market volatility and lowers the average cost of investments over time. It encourages disciplined investing and minimizes the risk of making poor decisions based on market timing.

Conclusion

Effective investment strategies for 2024 require a multifaceted approach, combining diversification, technological innovation, sustainability, real estate, global economic awareness, risk management, alternative investments, and disciplined investment practices. By staying informed about market trends and implementing these strategies, you can navigate the evolving financial landscape and achieve your investment goals.

As with any investment strategy, it’s crucial to conduct thorough research, assess your risk tolerance, and consult with financial advisors to tailor your approach to your individual needs. The dynamic nature of the investment world demands adaptability and proactive decision-making to ensure long-term success and financial growth.