Investing in the stock market can be a rewarding way to build wealth and achieve long-term financial goals. However, the stock market’s inherent volatility and complexity can be daunting for both new and experienced investors. To navigate these challenges effectively, it’s crucial to employ well-thought-out strategies that align with your investment goals, risk tolerance, and time horizon. In this comprehensive guide, we’ll explore various stock market investing strategies that can help you make informed decisions and enhance your investment success.

1. Understand Your Investment Goals

1.1 Define Your Objectives

Before diving into stock market investing, clearly define your investment objectives. Are you investing for retirement, a major purchase, or to grow your wealth? Your goals will influence your investment strategy and asset allocation.

1.2 Assess Your Risk Tolerance

Evaluate your risk tolerance to determine how much risk you’re willing and able to take. Risk tolerance is influenced by factors such as your financial situation, investment horizon, and emotional comfort with market fluctuations. Understanding your risk tolerance helps in selecting appropriate investments and managing your portfolio effectively.

2. Diversify Your Portfolio

2.1 The Importance of Diversification

Diversification involves spreading your investments across various asset classes to reduce risk and enhance potential returns. By diversifying, you can mitigate the impact of poor performance in any single investment.

2.2 Diversification Strategies

- Asset Allocation: Allocate your investments among different asset classes, such as stocks, bonds, real estate, and cash. A balanced portfolio can help manage risk and improve overall returns.

- Sector Diversification: Invest in a range of sectors, such as technology, healthcare, finance, and consumer goods. Different sectors may perform differently based on economic conditions, reducing the risk associated with sector-specific downturns.

- Geographic Diversification: Consider investing in international markets to benefit from global economic growth and reduce the impact of domestic market volatility.

3. Adopt a Long-Term Perspective

3.1 Benefits of Long-Term Investing

Adopting a long-term investment strategy involves holding investments for an extended period, typically several years or decades. This approach can help you ride out market fluctuations and benefit from compounding returns.

3.2 Strategies for Long-Term Success

- Buy and Hold: Invest in quality stocks with strong growth potential and hold them for the long term. This strategy allows you to benefit from the company’s growth and dividends over time.

- Dollar-Cost Averaging: Invest a fixed amount regularly, regardless of market conditions. This strategy helps smooth out the effects of market volatility and reduces the risk of making poor timing decisions.

4. Conduct Thorough Research

4.1 Fundamental Analysis

Fundamental analysis involves evaluating a company’s financial health, performance, and potential for growth. Key metrics to consider include:

- Earnings Per Share (EPS): Measures a company’s profitability on a per-share basis.

- Price-to-Earnings (P/E) Ratio: Compares a stock’s price to its earnings, indicating whether it’s overvalued or undervalued.

- Dividend Yield: Shows the annual dividend payment relative to the stock’s price, reflecting income potential.

4.2 Technical Analysis

Technical analysis focuses on historical price movements and trading volumes to predict future price trends. Key tools and indicators include:

- Moving Averages: Smooth out price data to identify trends and potential reversal points.

- Relative Strength Index (RSI): Measures the speed and change of price movements to identify overbought or oversold conditions.

- Bollinger Bands: Help identify volatility and potential price breakouts.

5. Implement Risk Management Techniques

5.1 Setting Stop-Loss Orders

A stop-loss order is a risk management tool that automatically sells a stock when its price falls to a certain level. This strategy helps limit losses and protect your investment from significant declines.

5.2 Position Sizing

Determine the appropriate amount to invest in each stock based on your overall portfolio and risk tolerance. Avoid over-concentrating your investments in a single stock, as this increases risk.

5.3 Regular Portfolio Review

Regularly review and rebalance your portfolio to ensure it aligns with your investment goals and risk tolerance. Rebalancing involves adjusting your asset allocation to maintain your desired risk level and investment strategy.

6. Stay Informed and Adapt

6.1 Follow Market Trends

Stay informed about market trends, economic indicators, and company news that may impact your investments. Utilize financial news sources, market reports, and investment research to make informed decisions.

6.2 Adapt to Changing Conditions

Be prepared to adjust your investment strategy in response to changing market conditions, economic developments, and personal financial circumstances. Flexibility and adaptability are key to long-term investment success.

7. Consider Professional Advice

7.1 Benefits of Working with a Financial Advisor

A financial advisor can provide personalized guidance and help you develop a tailored investment strategy. They can assist with:

- Investment Selection: Recommending suitable investments based on your goals, risk tolerance, and time horizon.

- Tax Planning: Offering strategies to optimize tax efficiency and minimize tax liabilities.

- Estate Planning: Assisting with estate planning to ensure your assets are distributed according to your wishes.

7.2 Choosing the Right Advisor

When selecting a financial advisor, consider their qualifications, experience, and fee structure. Look for advisors who are certified financial planners (CFPs) and have a fiduciary responsibility to act in your best interest.

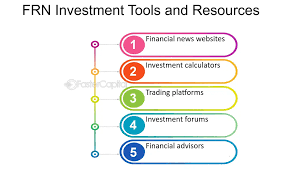

8. Utilize Investment Tools and Resources

8.1 Investment Apps and Platforms

Leverage technology to enhance your investment experience. Online investment platforms and apps offer tools for portfolio management, research, and trading. Key features to look for include:

- Real-Time Market Data: Access to up-to-date market information and stock quotes.

- Investment Research: Resources for analyzing stocks, bonds, and other assets.

- Portfolio Tracking: Tools to monitor your portfolio’s performance and track your investment goals.

8.2 Educational Resources

Stay informed by accessing educational resources such as books, online courses, and financial blogs. Continuous learning helps you stay updated on investment strategies and market trends.

Conclusion

Effective stock market investing requires a combination of thoughtful planning, diligent research, and strategic execution. By defining your investment goals, diversifying your portfolio, adopting a long-term perspective, and implementing risk management techniques, you can enhance your chances of achieving financial success. Staying informed about market trends, considering professional advice, and utilizing investment tools and resources further supports your investment journey. As you navigate the stock market in 2024, these strategies will help you make informed decisions and build a robust investment portfolio.