In 2024, managing and improving your credit score remains a crucial aspect of financial health. A good credit score can open doors to better loan terms, lower interest rates, and even affect job prospects and insurance premiums. Whether you’re looking to qualify for a mortgage, secure a credit card, or simply boost your financial profile, understanding how to improve your credit score is essential. Here’s a comprehensive guide to enhancing your credit score in 2024, complete with actionable steps and expert tips.

1. Understand Your Credit Score

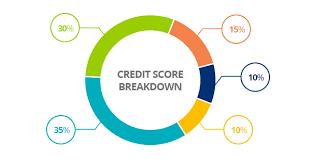

Before diving into improvement strategies, it’s essential to understand what constitutes a credit score and how it’s calculated. In the United States, credit scores typically range from 300 to 850, with higher scores indicating better creditworthiness. Major credit bureaus—Experian, Equifax, and TransUnion—calculate scores based on several factors:

- Payment History (35%): Timeliness of your payments on credit cards, loans, and other financial obligations.

- Credit Utilization (30%): The ratio of your credit card balances to their limits.

- Length of Credit History (15%): The age of your credit accounts.

- Types of Credit Accounts (10%): A mix of credit accounts, such as credit cards, mortgages, and installment loans.

- New Credit (10%): The number of recently opened credit accounts and credit inquiries.

2. Check Your Credit Reports Regularly

Regularly reviewing your credit reports is a crucial step in improving your credit score. Errors or inaccuracies on your reports can negatively impact your score. Obtain free copies of your credit reports from the three major credit bureaus at AnnualCreditReport.com. Review them for:

- Errors: Look for incorrect personal information, accounts that don’t belong to you, or incorrect account statuses.

- Fraudulent Activity: Ensure there are no accounts or inquiries you didn’t authorize.

- Discrepancies: Verify that all reported accounts and balances are accurate.

If you find any errors, dispute them with the credit bureau in writing. Correcting inaccuracies can lead to a better credit score.

3. Pay Your Bills on Time

Your payment history is the most significant factor influencing your credit score. Timely payments demonstrate reliability and can have a substantial positive effect on your score. Here are some tips to help you stay on top of payments:

- Set Up Automatic Payments: Enroll in automatic payments for your credit cards and loans to ensure bills are paid on time.

- Create Payment Reminders: Use digital calendars or mobile apps to set reminders for payment due dates.

- Pay More Than the Minimum: Whenever possible, pay more than the minimum amount due to reduce your balance faster and minimize interest charges.

4. Manage Your Credit Utilization Ratio

Credit utilization refers to the percentage of your available credit that you’re using. Keeping your credit utilization ratio low is vital for a good credit score. Aim to:

- Keep Utilization Below 30%: Ideally, use less than 30% of your available credit on each card. For example, if your credit limit is $1,000, try to keep your balance below $300.

- Pay Down Balances: Reduce outstanding balances on your credit cards as much as possible.

- Increase Credit Limits: Request a credit limit increase on your existing accounts, which can help lower your utilization ratio. However, avoid increasing your spending just because you have a higher limit.

5. Build a Strong Credit History

A longer credit history generally improves your credit score. Establishing and maintaining a strong credit history involves:

- Keeping Old Accounts Open: Don’t close old credit accounts, as they contribute to the length of your credit history.

- Using a Mix of Credit Types: Having a diverse range of credit accounts, such as credit cards, auto loans, and mortgages, can positively impact your score.

- Opening New Credit Wisely: Avoid opening too many new accounts in a short period, as this can lower your average account age and reduce your score.

6. Avoid Hard Inquiries

Each time you apply for new credit, a hard inquiry is made, which can temporarily lower your credit score. To minimize the impact of hard inquiries:

- Limit Applications: Only apply for new credit when necessary and avoid applying for multiple credit products simultaneously.

- Check Prequalification Options: Many lenders offer prequalification processes that don’t involve a hard inquiry, allowing you to gauge your eligibility without affecting your score.

7. Use Credit Responsibly

Responsible credit use involves managing your credit accounts wisely and avoiding behaviors that could harm your score. Here are some practices to follow:

- Monitor Your Accounts: Regularly check your credit card and loan statements to track spending and identify any potential issues.

- Avoid Overextending: Only charge what you can afford to pay off each month. Overextending yourself can lead to high balances and missed payments.

- Utilize Credit Monitoring Tools: Consider using credit monitoring services that alert you to changes in your credit report or score, helping you stay informed and proactive.

8. Address Any Existing Debt

If you have existing debt, create a plan to address it systematically. Options include:

- Debt Snowball Method: Focus on paying off your smallest debts first while making minimum payments on larger debts. Once a small debt is paid off, apply the funds to the next smallest debt.

- Debt Avalanche Method: Prioritize paying off debts with the highest interest rates first, saving money on interest in the long run.

- Consider Debt Consolidation: Explore consolidating your debts into a single loan with a lower interest rate, which can simplify payments and potentially reduce your total interest costs.

9. Seek Professional Advice

If you’re struggling to improve your credit score or manage debt, consider seeking advice from a financial advisor or credit counselor. These professionals can offer personalized strategies and support to help you achieve your financial goals.

- Credit Counseling Services: Look for non-profit credit counseling agencies that provide free or low-cost advice on managing debt and improving credit.

- Financial Advisors: Seek out advisors who specialize in credit management and can offer tailored advice based on your financial situation.

10. Stay Patient and Persistent

Improving your credit score takes time and effort. Stay patient and persistent as you work towards your financial goals. Celebrate small victories along the way, such as reducing your credit card balances or achieving a lower credit utilization ratio.

Conclusion

Improving your credit score in 2024 involves a combination of responsible credit use, timely payments, and strategic financial management. By understanding the factors that affect your credit score, regularly checking your credit reports, managing credit utilization, and addressing existing debt, you can enhance your credit profile and achieve better financial outcomes. Embrace these best practices, stay committed to your financial goals, and enjoy the benefits of a healthier credit score.