As we approach 2024, it’s essential to start thinking about tax planning strategies to minimize your tax liability and maximize your returns. Tax planning is a crucial aspect of financial management that helps individuals and businesses reduce their taxes legally and effectively. With tax laws constantly evolving, staying informed and proactive can lead to significant savings.

In this guide, we’ll explore the most effective tax planning tips for 2024. Whether you’re an individual taxpayer or a business owner, these strategies will help you make the most of your tax situation in the upcoming year.

1. Understand Changes in Tax Laws for 2024

One of the most critical steps in tax planning is staying updated on any changes to tax laws that may affect your situation. Tax regulations can shift due to new legislation, so it’s essential to keep an eye on any modifications that could impact your deductions, credits, or tax rates.

For 2024, the IRS may introduce adjustments to tax brackets, standard deductions, and contribution limits for retirement accounts. Understanding these changes can help you make informed decisions throughout the year. Consulting with a tax professional is a wise move to ensure you’re aware of any new opportunities or potential pitfalls.

2. Maximize Retirement Contributions

Contributing to retirement accounts is one of the most effective ways to reduce your taxable income while securing your financial future. In 2024, take full advantage of retirement savings vehicles such as 401(k)s, IRAs, and Roth IRAs.

- 401(k) Contributions: The contribution limit for 401(k) accounts may increase in 2024, so make sure to maximize your contributions. These contributions are tax-deferred, meaning you won’t pay taxes on the amount you contribute until you withdraw the funds in retirement.

- IRA Contributions: Traditional IRA contributions are tax-deductible, which can lower your taxable income. Roth IRAs, on the other hand, are funded with after-tax dollars, but qualified withdrawals are tax-free in retirement. Consider your current tax bracket and future expectations to determine the best option for you.

- Catch-Up Contributions: If you’re 50 or older, you can take advantage of catch-up contributions, which allow you to contribute more to your retirement accounts. This is a valuable tool to boost your retirement savings while reducing your taxable income.

3. Take Advantage of Tax Credits

Tax credits are more valuable than deductions because they reduce your tax bill dollar for dollar. For 2024, make sure you’re aware of all the credits you may be eligible for, as they can significantly lower your tax liability.

- Child Tax Credit: If you have dependents, the Child Tax Credit can provide substantial savings. Be sure to review the eligibility criteria and maximize this credit if applicable.

- Education Credits: The American Opportunity Credit and Lifetime Learning Credit can help offset education costs for yourself or your dependents. These credits can reduce the financial burden of tuition and other educational expenses.

- Energy-Efficient Home Improvement Credit: Investing in energy-efficient upgrades to your home, such as solar panels or energy-efficient windows, may qualify you for tax credits. With the growing emphasis on sustainability, these credits can be a win-win for your finances and the environment.

4. Strategically Plan Charitable Contributions

Charitable donations not only benefit the causes you care about but can also provide tax advantages. In 2024, consider how you can maximize your charitable giving to reduce your tax liability.

- Itemized Deductions: If you itemize your deductions, charitable donations can be a powerful way to lower your taxable income. Be sure to keep thorough records of your contributions, including receipts and documentation from the charities you support.

- Donor-Advised Funds: A donor-advised fund allows you to make a charitable contribution, receive an immediate tax deduction, and then recommend grants from the fund to your favorite charities over time. This strategy provides flexibility in your giving while allowing you to optimize your tax situation.

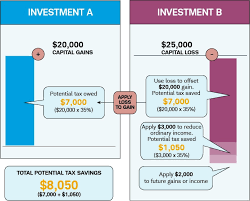

5. Consider Tax-Loss Harvesting

Tax-loss harvesting is a strategy that involves selling investments at a loss to offset capital gains in your portfolio. If you have investments that haven’t performed as well as expected, tax-loss harvesting can help you reduce your tax bill while rebalancing your portfolio.

For 2024, review your investment portfolio and identify any assets that have declined in value. Selling these investments can help you offset gains from other investments, reducing your overall taxable income. Keep in mind that the IRS has rules regarding the repurchase of the same or similar investments, known as the wash-sale rule, so be sure to follow these guidelines to avoid penalties.

6. Review Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs)

HSAs and FSAs are tax-advantaged accounts that allow you to save for medical expenses. These accounts can provide valuable tax savings if used effectively.

- HSA Contributions: If you have a high-deductible health plan, you may be eligible to contribute to an HSA. Contributions are tax-deductible, and withdrawals for qualified medical expenses are tax-free. In 2024, consider maximizing your HSA contributions to take full advantage of these tax benefits.

- FSA Contributions: FSAs also allow you to set aside pre-tax dollars for medical expenses, but unlike HSAs, they typically have a “use it or lose it” rule. Make sure to plan your contributions carefully and use the funds within the allotted timeframe to avoid losing money.

7. Optimize Your Tax Withholding

If you consistently receive a large tax refund each year, it may be a sign that you’re overpaying in taxes through withholding. While receiving a refund can feel like a bonus, it essentially means you’ve given the government an interest-free loan.

In 2024, review your W-4 form and consider adjusting your tax withholding to ensure you’re not overpaying or underpaying. By optimizing your withholding, you can keep more of your money throughout the year and avoid the need to wait for a refund.

8. Plan for Capital Gains and Dividends

If you have investments in stocks, bonds, or real estate, it’s essential to plan for capital gains and dividends in your tax strategy. In 2024, consider the timing of your asset sales to minimize your tax liability.

- Long-Term vs. Short-Term Capital Gains: Long-term capital gains (on assets held for more than a year) are typically taxed at a lower rate than short-term gains (on assets held for less than a year). Whenever possible, aim to hold investments for the long term to take advantage of the lower tax rates.

- Qualified Dividends: Qualified dividends are taxed at the same rates as long-term capital gains, which can be significantly lower than ordinary income tax rates. Be sure to understand the tax treatment of any dividends you receive and plan accordingly.

9. Consider Estate Planning

For individuals with significant assets, estate planning is a crucial component of tax strategy. Proper estate planning can help you minimize estate taxes and ensure that your assets are distributed according to your wishes.

In 2024, review your estate plan and consider strategies such as gifting assets to heirs, setting up trusts, and taking advantage of the federal estate tax exemption. Working with an estate planning attorney can help you navigate the complexities of estate taxes and ensure that your plan aligns with your financial goals.

Conclusion

Tax planning is an ongoing process that requires careful consideration and attention to detail. By staying informed about changes in tax laws, maximizing deductions and credits, and strategically managing your finances, you can reduce your tax liability and keep more of your hard-earned money in 2024.

Whether you’re an individual looking to optimize your personal tax situation or a business owner seeking to minimize corporate taxes, the tips outlined in this guide will help you plan for the year ahead. Remember, working with a tax professional can provide valuable insights and ensure that you’re taking full advantage of all available tax-saving opportunities